How To Find Equilibrium Level Of National Income

Determining Equilibrium National Income (With Example)

The following points highlight the top two methods of determining equilibrium national income. The methods are: 1. Aggregate Income-Expenditure Approach two. Savings-Investment Arroyo.

Method # i. Aggregate Income-Expenditure Approach:

In a two-sector Keynesian model, aggregate demand is composed of planned or desired consumption demand and planned investment need. The total of planned expenditure (C + I) must be equal to the value of output or income for a simple economic system to be in equilibrium.

Or when the C + I line cuts the 45° line, an equilibrium level of income is adamant. In other words, an equilibrium level of national income is determined at that point where aggregate demand (C + I) equals aggregate supply (i.e., the country'southward aggregate output or national income).

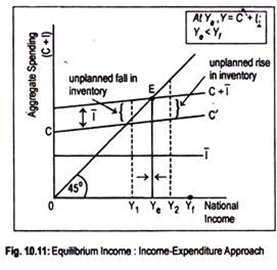

To illustrate equilibrium national output graphically, we use Fig. 10.xi where we mensurate national income on the horizontal centrality and aggregate demand or spending (C + I) on the vertical centrality. The 45° line is purely a reference line; whatsoever point on this line is equidistant from both the horizontal and vertical axes.

Aggregate spending (C + I) is equal to the value of income or output on this 45° line. For our exposition purposes, this line tin be thought of equally an aggregate supply curve, though information technology is non a 'true' aggregate supply curve.

With no government and strange trade sectors, aggregate need/expenditure is the sum of consumption need and investment need. In the Fig. 10.eleven, CC' is the planned consumption line. It shows the level of consumption for each level of income. Investment expenditure is assumed to exist democratic.

To demonstrate this, investment line I̅ has been drawn parallel to the horizontal axis. Past summing up the consumption and democratic investment schedules one obtains aggregate demand schedule (C + I̅). The vertical distance between the CC' line and the C + I̅ line measures the book of autonomous investment.

Point E is the equilibrium betoken, since C + I̅ line cuts the 45° line at that point. Equilibrium level of income, thus determined, is OYe since it is the only level of income at which aggregate need and aggregate value of output (or income) are equal to each other.

That is,

Y = C + I̅

We can testify that this equilibrium level of income is a stable one. This means that if the level of income is either more than or less than OYeast, then there will be a tendency for the level of income to move toward OYe. Otherwise, equilibrium is said to be unstable. Suppose, if income is OY1 (< OYe), aggregate demand will exceed amass supply or aggregate output.

That is, C + I̅ > Y

Now there will be an backlog demand for goods and services, resulting in an unplanned reduction of inventories. (Recollect that inventories are part of investment.) As inventories decline, business organization firms footstep upward production. Thus, output will continue to rise till OYdue east is achieved. Similarly, at OY2 level of income, aggregate supply exceeds aggregate demand.

That is, Y > C + I̅

This means an excess supply of goods and services. People are not willing to purchase all the appurtenances that the nation has produced. Thus, in that location will be an unintended accumulation of inventories past producers. Firms will now exist forced to cutting back product. Output will continue to decline till OYe is attained. Only at OYe there is neither unplanned accumulation nor depletion of inventories. Thus, OYe is in stable equilibrium.

To accept a stable equilibrium of income one condition is needed—slope of the line (C + I̅) must be equal to gradient of the CC' line. The slope of the consumption line CC' is the MPC whose value must always exist less than unity.

Diagrammatically, this means that the (C + I̅) line must cut the 45° line from in a higher place. If (C + I̅) line cuts the 45° line from beneath then the value of MPC would be greater than unity and equilibrium income thus determined in this manner would be unstable.

Method # 2. Savings-Investment Approach:

Full withdrawals from and injections into the circular flow determine equilibrium national income. In a ii-sector economy, withdrawal comprises only saving, while injection comprises merely investment.

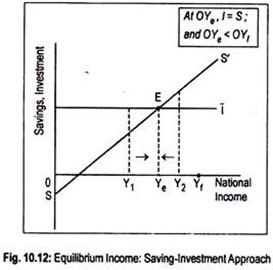

Equilibrium national income is determined at that point when planned saving and planned investment are equal to each other. Diagrammatically, at the intersection of the saving and investment line, equilibrium national income is determined.

In Fig. 10.12, we measure national income on the horizontal axis and savings and investment on the vertical centrality. SS' is the planned savings curve which has a negative intercept in the sense that, at low level of income, since consumption exceeds income, savings must exist negative.

Equally usual, I̅ is the autonomous investment line drawn parallel to the horizontal centrality. As SS' curve cuts I̅ at signal E, equilibrium level of income is, thus, adamant at OYe. In other words, planned saving and planned investments are equal only at the intersection of the 2 curves and, thus, equilibrium income is OYeastward. And this equilibrium income is a stable one.

To run into whether OYe is a stable equilibrium income, nosotros consider OY1 or OY2 level of income. If the deviation from OYe level of income gets corrected or if the equilibrium income OYe is attained after deviation, then equilibrium is said to be a stable one.

At OY1 level of income, investment (injection) exceeds saving (leakage). Aggregate demand must exceed aggregate output. This will effect in an unplanned reduction of inventories to meet excess demand. Consequently, output volition rise until planned saving and planned investment are equal. Similarly, at OY2 level of income, since saving exceeds investment, aggregate demand falls curt of aggregate supply.

Hence, an excess supply of bolt volition announced leading to an unplanned accumulation of inventories. This volition human action as an incentive to cutting back output. Output volition continue to decline until point E is reached where OYdue east equilibrium level of national income is adamant. Thus, OYeast is a stable equilibrium.

The condition for stability is that the saving curve must be positively sloped. MPS is the slope of the saving function. To have stability the value of MPS must be positive but less than 1. Retrieve that MPS is complementary to MPC. If MPC < 1, then MPS must be less than one since MPC + MPS = 1. Thus, the status for stability in equilibrium income in both the approaches is the same, i.east., 0 < MPC < ane.

A Numerical Example on the Determination of Equilibrium National Income in a Two-sector Economy:

Suppose, consumption (C) is given by the consumption part

C = 5 + 0.8Y

Where, Y is income.

Assume that investment is autonomous (I̅) and is given by

I̅ = Rs. ten

It says that investment is an exogenous variable. As it is determined outside the model, investment is merely considered every bit given.

With this information, we want to derive the equilibrium values of income, consumption saving, and investment.

Solution:

Equilibrium condition is Y = C +i, where C = a + past and I = I̅. Putting the values of C and I, we obtain

Y = a + bY + I̅

Or,Y – past = a + I̅

or, Y (I – b) = a + I̅

. . . Y = 1/1 – b (a + I̅)

Here, Y is the equilibrium level of income. Substituting the consumption and investment equations into equation Y, we get

Y = 1/one – 0.8 (5 + 10) = Rs. 75

Thus, C = 5 + 0.8(75) = Rs. 65, and

S = Y – C = 75 – 65 = Rs. x

I = Rs. 10

The above approach has an alternative approach, known every bit saving-investment approach.

Culling Solution:

Equilibrium condition now is Due south = I

S = Y – C

= Y – a – bY

= – a + (1 – b) Y

Bold I̅ = I̅, the equilibrium condition becomes

– a + (1- b) Y = I̅

So the equilibrium level of income is

Y = 1/1 – b (a + I̅)

From the consumption function C = five + 0.8Y we find the values of -a and (i – b). If a = 5 and so (-a) = -5 and if b = .8 then (1 – b) = 0.ii. Now putting these values into saving and investment equation, we become

– 5 + 0.2Y = 10

0.2Y – v = ten

0.2Y =ten + 5

Or, Y = fifteen/0.2 = Rs. 75

If Y = Rs. 75, saving must be equal to Rs. 10 since consumption is Rs. 65.

Note that since the two forms of equilibrium condition are equivalent, the level of income must be the same.

How To Find Equilibrium Level Of National Income,

Source: https://www.economicsdiscussion.net/national-income/determination/determining-equilibrium-national-income-with-example/17362

Posted by: benitohoure1990.blogspot.com

0 Response to "How To Find Equilibrium Level Of National Income"

Post a Comment