How To Find Dividend Of A Stock

What is Dividend Per Share (DPS)?

Dividend Per Share (DPS) is the full amount of dividends attributed to each individualshare outstanding of a company. Calculating the dividend per share allows an investor to determine how much income from the company he or she will receive on a per-share basis. Dividends are usually a cash payment paid to the investors in a visitor, although in that location are other types of payment that can be received (discussed below).

Dividend Per Share Formula

The formula for calculating dividend per share has ii variations:

Dividend Per Share = Total Dividends Paid / Shares Outstanding

or

Dividend Per Share = Earnings Per Share x Dividend Payout Ratio

Download the Free Template

Enter your name and e-mail in the class below and download the costless template at present!

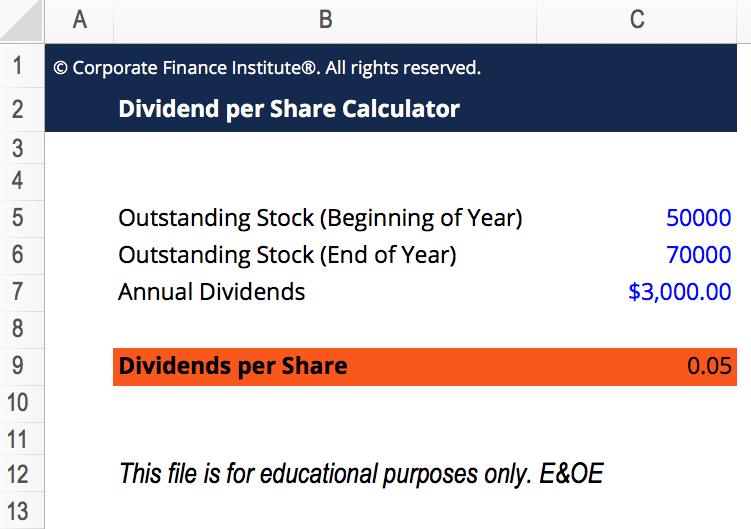

Dividend per Share Calculator

Download the complimentary Excel template at present to advance your finance cognition!

Types of Dividends

Although dividends are ordinarily a greenbacks payment paid to investors, that is non ever the example. There are several types of dividends, such as:

1. Cash dividends

This is the most common course of dividend per share an investor will receive. It is only a cash payment and the value tin be calculated by either of the above two formulas.

2. Holding dividends

The visitor bug a dividend in the grade of an nugget such as belongings, establish, and equipment (PP&E) , a vehicle, inventory , etc.

3. Stock dividends

The company gives each shareholder a certain number of extra shares based on the current amount of shares that each shareholder owns (on apro-rata ground).

four. Scrip dividends

The company promises payment to shareholders at a later date. Scrip dividends are essentially a promissory annotation to pay shareholders at a future engagement.

5. Liquidating dividends

The visitor liquidates all its avails and pays the sum to shareholders as a dividend. Liquidating dividends are usually issued when the visitor is well-nigh to shut down.

Dividend Per Share Instance

Company A announced a total dividend of $500,000 paid to shareholders in the upcoming quarter. Currently, there are one one thousand thousand shares outstanding.

The dividend per share would simply be the total dividend divided past the shares outstanding. In this case, it is $500,000 / i,000,000 = $0.50 dividend per share.

Calculating DPS from the Income Statement

If a visitor follows a consistent dividend payout ratio (i.e., the company is known to pay a consistent percentage of its earnings equally dividends), a rough guess of the dividend per share tin be calculated through the income argument. To calculate the DPS from the income argument:

one. Figure out the net income of the company

Net income is generally the final item on the income statement .

2. Determine the number of shares outstanding

The number of shares outstanding can typically be plant on the company's remainder sheet . If in that location are treasury shares, it is important to decrease those from the number of issued shares to get the number of outstanding shares.

three. Dissever net income by the number of shares outstanding

Dividing net income by the number of shares outstanding would give you lot the earnings per share (EPS) .

Alternatively:

four. Determine the company's typical payout ratio

Guess the typical payout ratio by looking at past historical dividend payouts. For example, if the company historically paid out between 50% and 55% of its internet income as dividends, use the midpoint (53%) as the typical payout ratio.

five. Multiply the payout ratio by the net income per share to get the dividend per share

Sample Dividend Per Share Calculation

Visitor A reported a net income of $10 million. Currently, there are 10 meg shares issued with 3 one thousand thousand shares in the treasury. Company A has historically paid out 45% of its earnings as dividends.

To approximate the dividend per share:

- The net income of this company is $10,000,000.

- The number of shares outstanding is 10,000,000 issued – three,000,000 in the treasury = 7,000,000 shares outstanding.

- $10,000,000 / 7,000,000 = $ane.4286 internet income per share.

- The company historically paid out 45% of its earnings as dividends.

- 0.45 ten $ane.4286 = $0.6429 dividend per share.

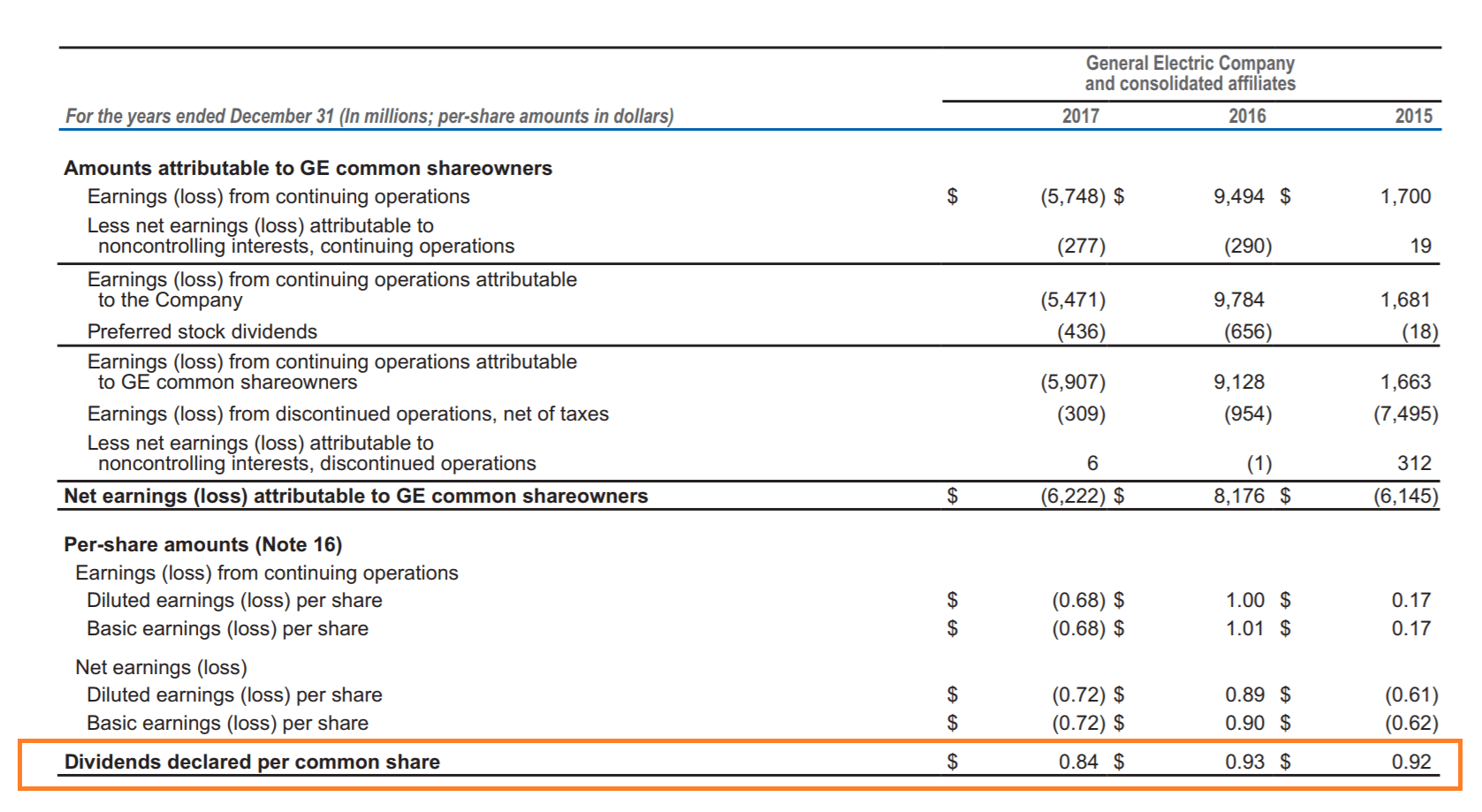

Example of Dividend per Share

Below is an example from GE's 2017 annual report. In their financial statements is a section that outlines the dividends declared per common share. For like shooting fish in a barrel reference, you tin can compare the dividends to the net earnings per share (EPS) in the same flow.

The Rationale for Paying a Dividend to Shareholders

Permit us consider two cardinal reasons as to why companies cull to issue dividends:

ane. To attract investors

Many investors savor receiving dividends and view them as a steady income source. Therefore, these investors are more attracted to dividend-paying companies.

two. To signal the company'southward strength

Paying a dividend to shareholders may exist a signaling method by the company. Dividend payments are typically associated with a strong visitor with positive expectations nearly its future earnings. This makes the stock more than attractive and may increase the market value of the company'south stock.

The Rationale for Non Paying a Dividend

Although dividends can be used to signal a company'south force and concenter investors, there are too several of import reasons as to why companies practice not result dividends:

one. Rapid growth

A company that is growing quickly most likely won't pay dividends. The earnings of the company are instead reinvested to help fund further growth.

2. Internal investment opportunities

A mature company may hold onto its earnings and reinvest them. The money may be used to fund a new projection, acquire new assets, or pursue mergers and acquisitions (M&A) .

3. Wrong signaling

If a company originally issues dividends but decides to pull back on its dividend payout, it can create unfavorable signaling for the company. When companies eliminate or reduce their existing dividend policy, this is typically viewed negatively by investors. Therefore, companies may avoid paying dividends at all to avoid this problem.

Additional Resources

Thank you for reading CFI's guide to dividend per share. To aid yous in your journey of condign a world-course financial analyst, these boosted CFI resources will be helpful:

- Earnings Per Share

- Majuscule Structure

- Dividend vs Share Buyback/Repurchase

- Fiscal Modeling Valuation and Analyst Guide

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/dividend-per-share/

Posted by: benitohoure1990.blogspot.com

0 Response to "How To Find Dividend Of A Stock"

Post a Comment